Table Of Content

If you file a hurricane-related claim and go five consecutive years without filing a claim after that, you can get up to 100% of your hurricane deductible back in cash. Security First Insurance is one of the cheapest home insurance companies we've seen not just in Florida, but nationwide. While rates remain high, there is a sign that change is on the horizon — Citizens Insurance was able to move over 300,000 policies to private insurers, and new insurance companies are entering the market this year.

Windstorm insurance

Florida home insurance companies often face a no-win situation when they fight an insurance claim in court, thanks to the state’s Assignment of Benefits (AOB) law. AOB allows a homeowner to turn his or her claim over to a contractor instead of dealing with the insurer. The contractor can then hire an attorney, often before talking to the insurance company.

Florida homeowners insurance rates by coverage amount

Prices may rise at a slower rate in the future, but insurance costs are predicted to jump as high as 50% or more for some Floridians this year. Medders explains that those rebuilding costs were also affected by inflation. “The cost of construction materials and labor rose during 2021–2023 at rates surpassing the overall inflation rates, making payment of claims more expensive than expected,” Medder says.

How to get cheap homeowners insurance in Florida

USAA ranks highly across the country, with both customer satisfaction and affordability scores above 4. Additionally, ensure that you have the right amount and type of coverage in place before hurricane season approaches. The best way to safeguard your property and financial interests is to choose the right insurer. While many companies have gone bankrupt or are refusing to write new policies in Florida, there are still companies making sure Florida homeowners are protected,” says Anthony Martin, CEO of Choice Mutual.

Florida homeowners pay 5x more for insurance than the national average, report says - WFLA

Florida homeowners pay 5x more for insurance than the national average, report says.

Posted: Wed, 03 Apr 2024 07:00:00 GMT [source]

Coverage B, C, and D are typically a percentage of your dwelling coverage, often about 20%. For your personal property, we usually recommend a minimum of $100,000. Flood insurance and sinkhole insurance are both available as endorsements, but they are not part of your standard home insurance policy. If you’re eligible for coverage, you can add them simply by selecting the endorsements in our online application or asking your representative for help. One reason may be that Miami has a higher risk of hurricane damage than Jacksonville.

The move is the latest in a series of attempts by the State House to reverse the trend of increasing insurance costs. Earlier this year, Slide Insurance, founded in 2021, also took on 126,000 Citizens Property Insurance policies, the state’s insurer of last resort. Citizens going insolvent would cause more upheaval in the Florida home insurance market and likely lead to the federal government having to bail out the program. One major complaint is that insurers are trying to ward off the threat of having to pay for new roofs by rejecting customers who have asphalt shingle roofs that are more than 10 years old. Florida’s population is heading for 22 million and it accounts for just 8% of property claims nationwide. But Florida has more than three-quarters of all property claims lawsuits, many of which lawmakers say are frivolous.

Company

This guide provides details on the program, including eligibility and the request process. Residential property mediation allows you to settle disputes regarding all residential property claims resulting from damage to your house, dwelling, mobile home or condominium. The Department of Financial Services mediation program assist consumers who are having difficulty getting residential insurance claims resolved.

Insurer seeking homeowner insurance rate increase from Florida regulators - WPTV News Channel 5 West Palm

Insurer seeking homeowner insurance rate increase from Florida regulators.

Posted: Mon, 01 Apr 2024 07:00:00 GMT [source]

Across Florida, condo sellers have had to slash prices due to rising insurance and homeowners association costs. Condo prices in Jacksonville dropped nearly 7% year over year, while Miami’s decreased almost 3%. Meanwhile, average U.S. condo list prices are up over 8%, according to another Redfin report released in February. Your past claims history reveals that you tend to make a lot of claims, making you riskier to insure. That shows the issues of previous homeowners that could also affect you.

Best for older homes & roofs: Universal Property

She has more than 15 years of experience writing, editing and managing content in a variety of industries, including insurance, auto news and pop culture. It’s always wise to review your policy closely to understand what is excluded from coverage. Companies that primarily sell insurance in Florida could choose not to sell policies in areas with a high risk of storm losses—specifically coastal counties. Weston’s approximately 20,000 Florida customers have 30 days to find home insurance elsewhere. Florida Insurance Guaranty Association will handle Weston’s outstanding claims. DeSantis said the legislation will help reverse problems with Florida’s legal system and put it more in line with the rest of the country.

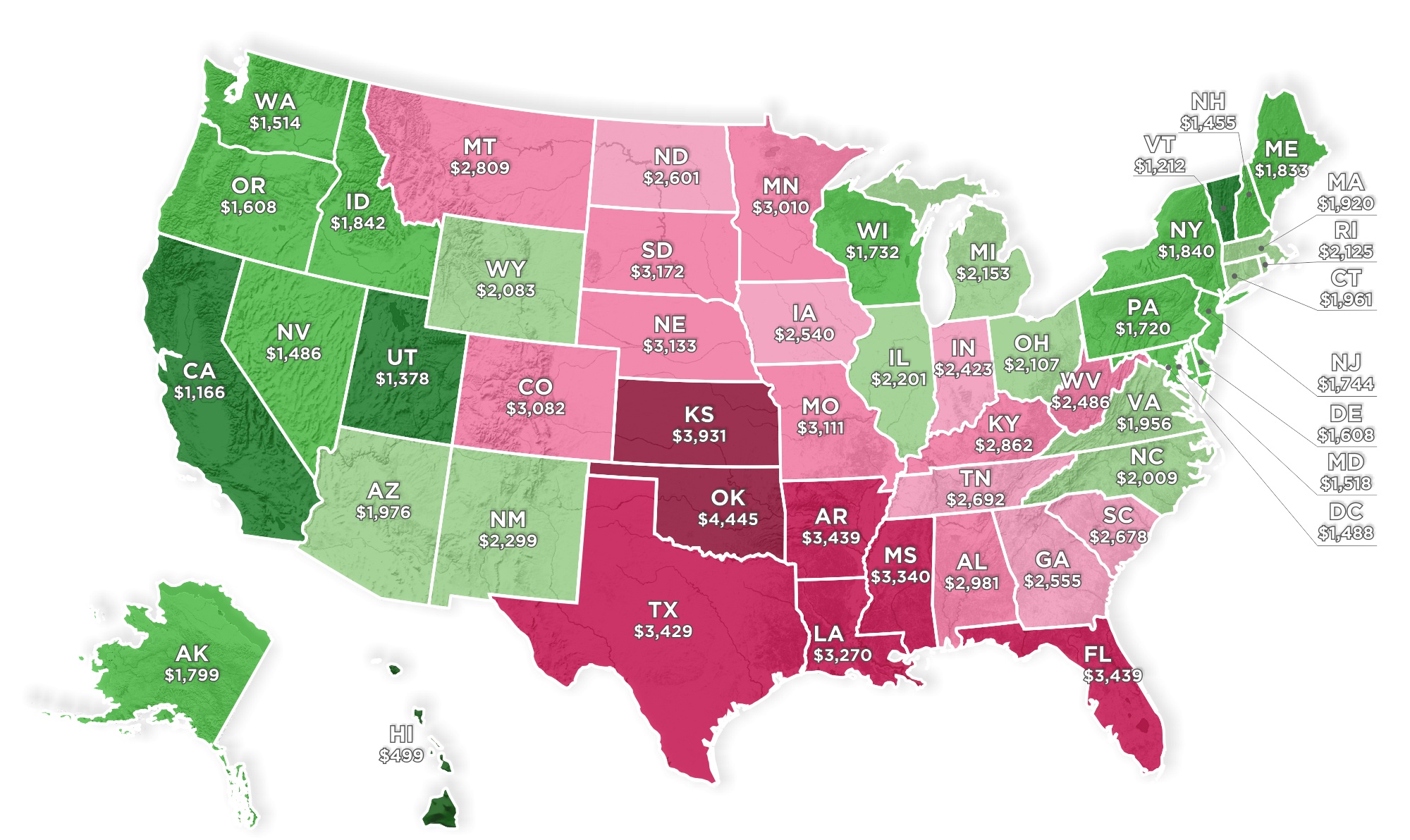

S&P Global reported an average rate increase of 42.1% since 2022 in Florida. An Insurance.com survey found Florida to be the hardest hit by the insurance crisis, along with California. Home insurance rates can vary by city from $3,604 a year in Cape Coral to $4,177 in Orlando. Consider Progressive and State Farm, too, as their discounts and customer service could make them the better choice for some homeowners. The above is meant as general information and as general policy descriptions to help you understand the different types of coverages.

You can buy flood insurance in Florida through the government-run National Flood Insurance Program (NFIP) or from private flood insurance companies. Standard home insurance policies don’t cover flood damage or destruction. Depending on where you live, you might need flood, windstorm and/or sinkhole coverage as well. Homeowners in Pinellas County pay the cheapest home insurance rates of Florida’s biggest counties.

This website is using a security service to protect itself from online attacks. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. This issue is now a significant component of denying coverage due to the current Florida insurance climate, says Friedlander.

Should you wish to locate a company that is not listed in our evaluation, simply look up the company's J.D. Power satisfaction score and National Association of Insurance Commissioners (NAIC) complaint ratios in your state. You can also use Florida's Department of Insurance to make this task easier.

Knowing what options are available for getting coverage is the first step in finding ways to save on homeowners insurance. You’ll pay $1,142 per year on average for $350,000 of dwelling coverage in Florida with State Farm, though your policy costs might increase with add-ons or decrease with discounts. We researched 21 Florida homeowners insurance companies to find the best homeowners insurance in Florida based on availability, rates and customer satisfaction.

Our partners cannot pay us to guarantee favorable reviews of their products or services. Pat Howard is a managing editor and licensed home insurance expert at Policygenius, where he specializes in homeowners insurance. His work and expertise has been featured in MarketWatch, Real Simple, Fox Business, VentureBeat, This Old House, Investopedia, Fatherly, Lifehacker, Better Homes & Garden, Property Casualty 360, and elsewhere. While these rate increases need to be approved by the Florida Office of Insurance Regulation before they take effect, they’re still a startling indication of the rising cost of home insurance in Florida. The average cost of Universal Property home insurance in Florida is $2,314 per year, which is on par with the annual statewide average of $2,288. The average cost of Tower Hill home insurance in Florida is $1,189 per year, which is around $1,000 cheaper than the annual statewide average of $2,288.

The insured should also compile an inventory of all damaged personal property. The inventory should include the date of purchase, quantity, description, value, and the amount paid for each item. The insured may be asked to provide receipts, bills, and any other related documents to justify the amounts provided. The inspection may also verify the maintenance of the home such as whether the property has any unrepaired damage. The insurer considers whether the home is properly maintained, such as, overgrown grass and weeds, trees with dead limbs near the home, non-operating vehicles on the property, etc. If the insurer finds any of the risks listed above (this is not an all-inclusive list), they may refuse coverage.

No comments:

Post a Comment